Question:

What should you look for in a rental property?

Answer:

Buying a rental property can be a fantastic source of income if you take the time to focus on the factors that will provide positive cash flow. Check out this article that lists what to consider when buying a rental property.

Question:

Will the housing market crash again?

Answer:

Compared to this time last year the market has without question slowed. Shifts in the market are normal and healthy and it is important to understand why we won't see a repeat of 2008. Check out this article that highlights a few good points on why we are not headed for a housing crash.

Question:

How do you know if you can afford a home?

Answer:

Buying a home can often times seen like a daunting process and is put off as a long term goal for most. There is a lot of upside to purchasing sooner rather than later, but it is important to take a few proactive steps to make sure you are realistic about what you can afford. Check them out!

Question:

What do you need to do to get preapproved before buying a home?

Answer:

A smart first step in beginning your home search is getting yourself preapproved. This will provide parameters for what you can spend on a home and allow you to search realistically. Want to know more about what being preapproved actually means? Click Here.

Question:

How should you prep your home before listing?

Answer:

Prepping your home before a listing may seem simple at first, but in fact there may be a lot more 'to dos' to complete to make your home market ready. You will want your home to appeal to as many buyers as possible therefore doing things such as taking down personal pictures, painting walls neutral colors, etc., are generally a good idea. Ask your agent for a check list on what you can do to prep your home before listing. You will want to focus not only on the interior of your home but also the exterior (many buyers will do a drive by before deciding to tour your home).

Question:

Are mortgage rates high?

Answer:

Mortgage rates have recently increased to about ~5%. Is there reason for concern? Will they continue to rise? Today's interest rates appear to be high as they were just ~3% a few months ago. We can not predict what they will be in the next two, three years, although we may see a steady and slight increase. However, it's important to look at what rates have been long term (as high as 12%). Rates are still low in comparison.

When going through the home buying process, we suggest talking to more than one lender but advise to avoid just shopping rates. Understand what your total costs will amount to and go with a lender you trust and enjoy working with as rates are just a piece of the puzzle.

Question:

Should you continue to rent or purchase a home?

Answer:

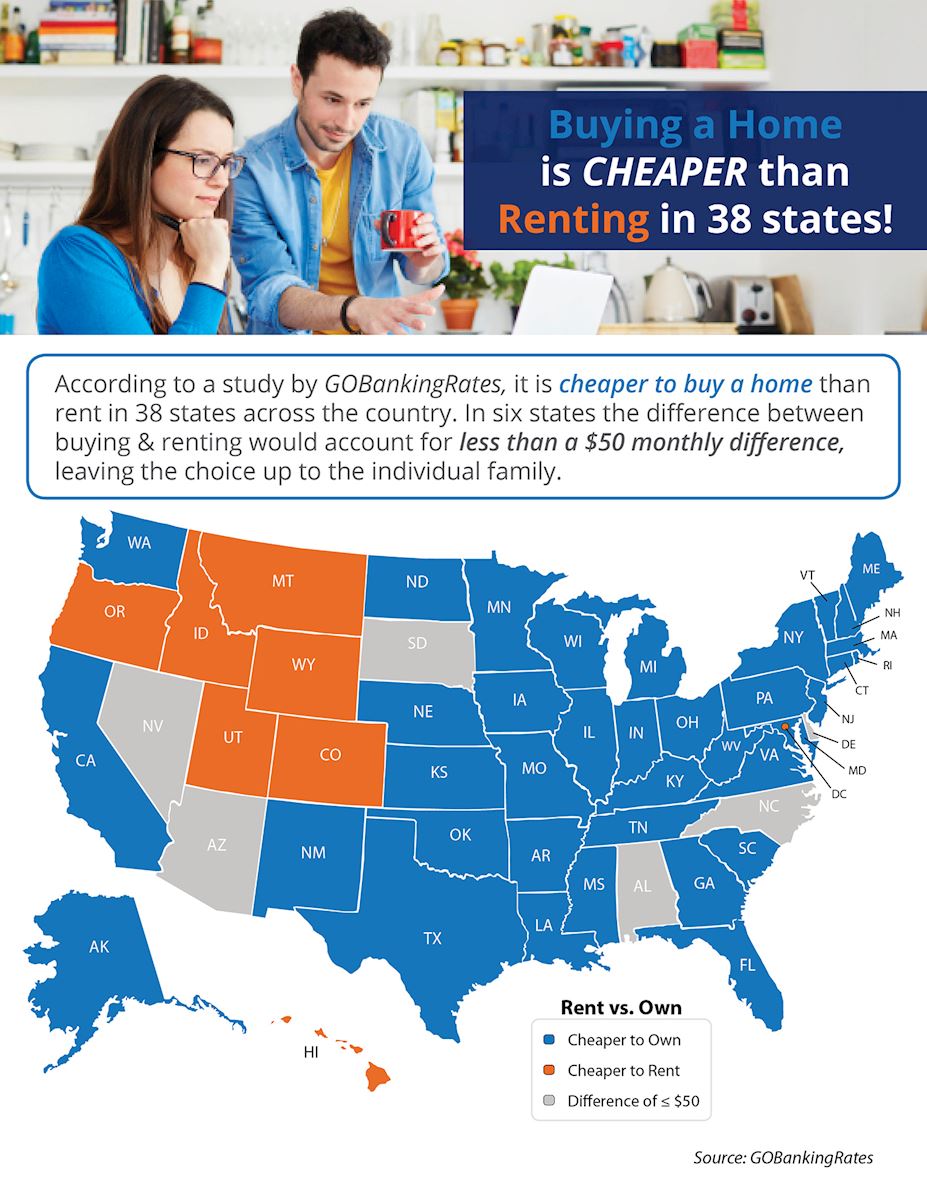

If homeownership is something within your financial reach, it is definitely worth exploring and can be an excellent investment. Before making any decisions, it is necessary to fully understand what you can afford, expenses incurred at time of purchase as well as after, and an in depth understanding of the market you plan to buy in today and projections of what it will potentially do in years to come.

The below articles provide quick overviews of why it's a smart move to buy vs. rent as well as what states you should buy vs. rent in.

Question:

Which is a better investment? Home or condo?

Answer:

Real Estate is a fantastic way to invest and if you are considering purchasing a condo or a home it's necessary to weigh the pros and cons of each. Costs associated with a home are typically more upfront and you are allotted more freedom and flexibility to maintain your home as you please. Condos are usually cheaper but there a few things you need to review before you decide to buy. The below articles do a great job outlining what to consider; things such a HOA costs, upcoming special assessments, if the rental cap is met, etc.

https://www.landlordology.com/investing-in-condos/

https://www.moneyunder30.com/condo-vs-single-family-house

Question:

Should a buyer use a fixed or adjustable rate mortgage?

Answer:

The below article provides an easy to understand overview on the differences between a fixed rate mortgage vs. adjustable rate mortgage, so we recommend giving it a read.

A fixed rate mortgage locks in your interest rate, provides predictable payments, therefore is the safer option. An adjustable rate mortgage's interest changes, resulting in payment fluctuations each month. Adjustable rate mortgages are often hybrid; start off fixed and transition to changing rates. Additionally, adjustable rate mortgages are often lower than fixed rate mortgages. Therefore, in a scenario where rates decline or stay as is, adjustable rate mortgages result in a lower overall payment.

Please keep in mind your Real Estate Agent is a great resource for guidance on this topic, but you should be making your decisions only after you have examined all options with a financial expert (i.e. your lender).

Fixed vs. Adjustable Rate Mortgage Article

Question:

Should a seller pre-inspect their home before listing?

Answer:

Sellers' pre-inspections have appeared to become the norm this past year, and although there is some definite upside to doing one before listing your home, it is important to understand the pros and cons. We like to point out to our clients that doing a pre-inspection before listing does not necessarily result in potential buyers waiving their inspection contingency. They have a right, and most likely will, go through this process themselves. Doing a pre-inspection before listing may be enough for your buyer to waive this contingency although more importantly, doing so will provide peace of mind and time before listing to fix issues that come up.

Be aware of the liability a seller will have upon doing their own pre-inspection. If you choose to go this route, chat with your realtor about hiring an accredited inspection company.

https://www.realtor.com/advice/sell/should-home-sellers-get-a-pre-inspection/?is_wp_site=1

Question:

Is the Real Estate market really crashing?

Answer:

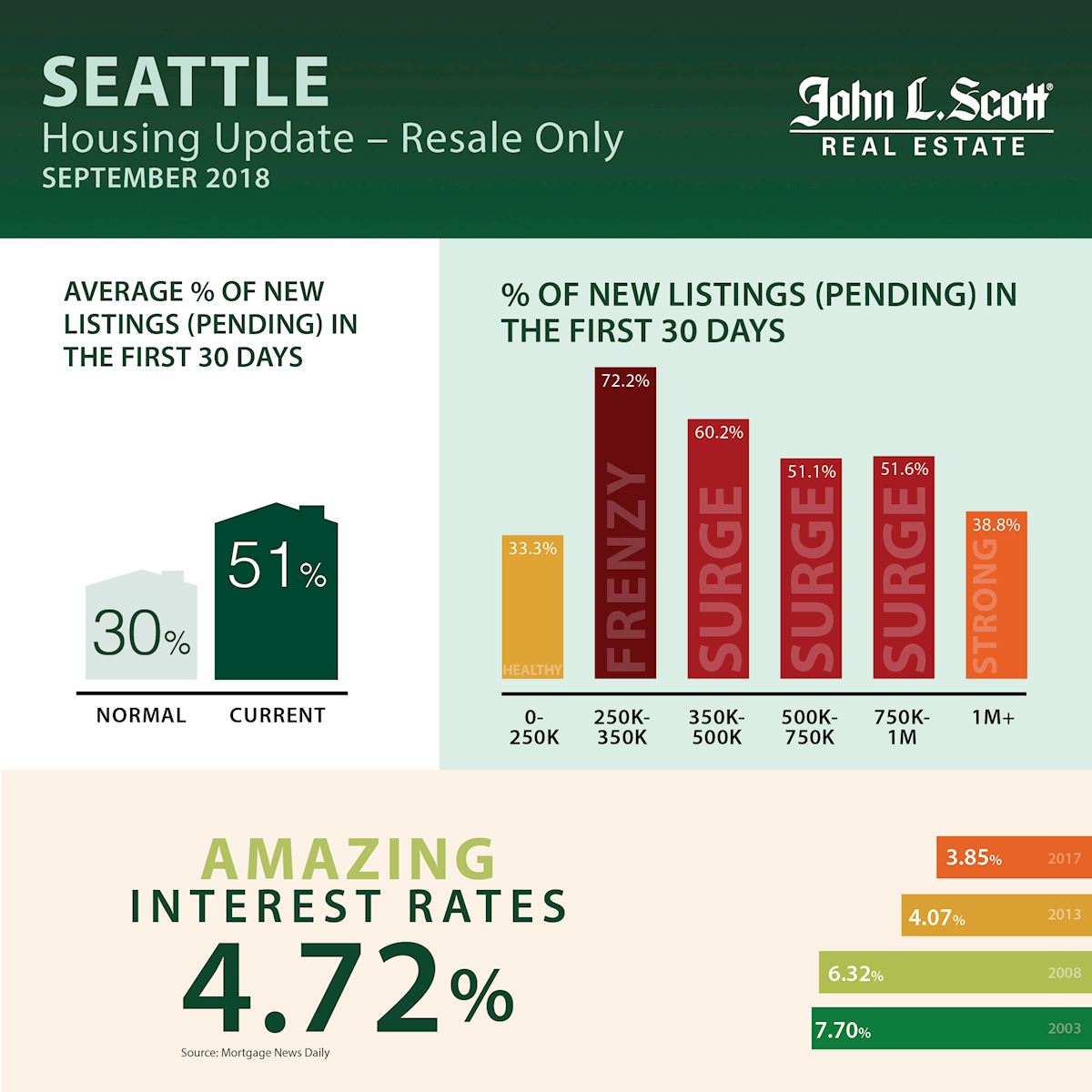

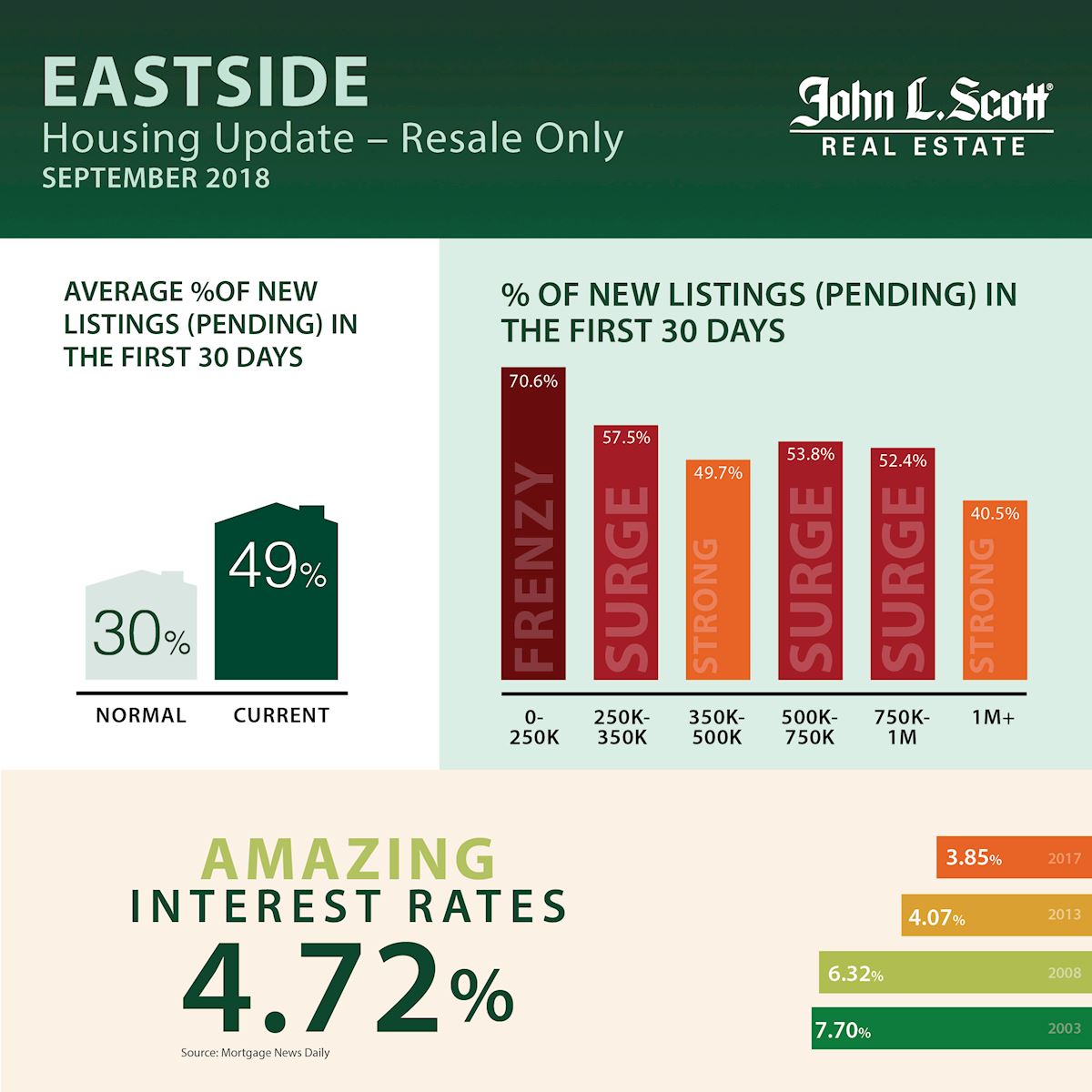

It's likely you have come across an article or two indicating in some fashion the Real Estate market is crashing. It's true the market has slowed down but it is still healthy and competitive. Check out the infographics I have posted below for the Seattle and Eastside markets. This past year, we have seen about 70-80% of homes go pending in less than 30 days. We saw low supply and demand unable to keep up. Today, ~50% of homes are pending in less than 30 days; still an impressive number. Supply is catching up with demand and normalizing the market. The days of listings going pending in two days after receiving 15 offers have lessened, but by no means has the market crashed and is still strong and reflective of Seattle's economical growth.